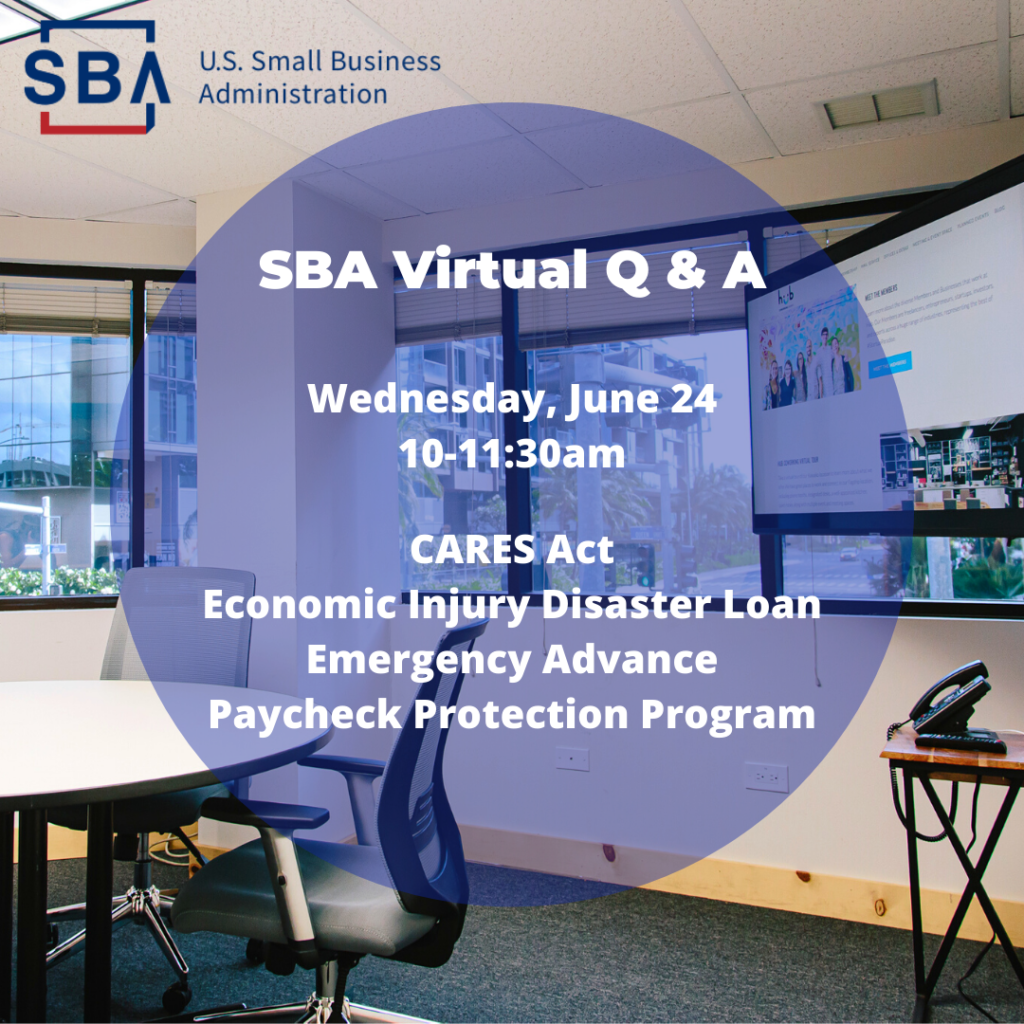

The Small Business Association (SBA) office in Hawai’i has graciously offered a FREE virtual Q & A to cover the topics of the SBA type loans in the CARES Act. If you have received a grant or loan in the form of a Paycheck Protection Program (PPP) or Economic Injury Disaster Loan or others and have questions about how to use them, what will it cost, terms, what if I don’t want it anymore, etc. tune in next Wednesday. If you haven’t received a loan and are curious if you still can, this is a good place to get your questions answered.

Mary Dale will be discussing: CARES Act, Paycheck Protection Program, Economic Injury Disaster Loan Emergency Advance and new changes to the borrower application form, and a modified loan forgiveness application implementing these legislative amendments to the PPP.

Please see these helpful links and information here, and tune into the Microsoft Meeting on Wednesday June 24 from 10am to 11:30am HST.

Meeting link here:

Join Microsoft Teams Meeting

+1 202-765-1264 United States, Washington DC (Toll)

Conference ID: 561 769 643#

The meeting will be led by SBA Economic Development Specialist Mary Dale, and SBA Deputy District Director Mark Spain.

About the U.S. Small Business Administration

The U.S. Small Business Administration makes the American dream of business ownership a reality. As the only go-to resource and voice for small businesses backed by the strength of the federal government, the SBA empowers entrepreneurs and small business owners with the resources and support they need to start, grow or expand their businesses, or recover from a declared disaster. It delivers services through an extensive network of SBA field offices and partnerships with public and private organizations. To learn more, visit www.sba.gov

Upcoming Procedures

SBA, in consultation with Treasury, will promptly issue rules and guidance, a modified borrower application form, and a modified loan forgiveness application implementing these legislative amendments to the PPP. These modifications will implement the following important changes:

Extend the covered period for loan forgiveness from eight weeks after the date of loan disbursement to 24 weeks after the date of loan disbursement, providing substantially greater flexibility for borrowers to qualify for loan forgiveness. Borrowers who have already received PPP loans retain the option to use an eight-week covered period.

- Lower the requirements that 75 percent of a borrower’s loan proceeds must be used for payroll costs and that 75 percent of the loan forgiveness amount must have been spent on payroll costs during the 24-week loan forgiveness covered period to 60 percent for each of these requirements. If a borrower uses less than 60 percent of the loan amount for payroll costs during the forgiveness covered period, the borrower will continue to be eligible for partial loan forgiveness, subject to at least 60 percent of the loan forgiveness amount having been used for payroll costs.

- Provide a safe harbor from reductions in loan forgiveness based on reductions in full-time equivalent employees for borrowers that are unable to return to the same level of business activity the business was operating at before February 15, 2020, due to compliance with requirements or guidance issued between March 1, 2020 and December 31, 2020 by the Secretary of Health and Human Services, the Director of the Centers for Disease Control and Prevention, or the Occupational Safety and Health Administration, related to worker or customer safety requirements related to COVID–19.

- Provide a safe harbor from reductions in loan forgiveness based on reductions in full-time equivalent employees, to provide protections for borrowers that are both unable to rehire individuals who were employees of the borrower on February 15, 2020, and unable to hire similarly qualified employees for unfilled positions by December 31, 2020.

- Increase to five years the maturity of PPP loans that are approved by SBA (based on the date SBA assigns a loan number) on or after June 5, 2020.

- Extend the deferral period for borrower payments of principal, interest, and fees on PPP loans to the date that SBA remits the borrower’s loan forgiveness amount to the lender (or, if the borrower does not apply for loan forgiveness, 10 months after the end of the borrower’s loan forgiveness covered period).

- In addition, the new rules will confirm that June 30, 2020, remains the last date on which a PPP loan application can be approved.