Crowdfunding is a type of financial support that allows curious or excited individuals to pledge money to companies, people, or products that spark interest. And that interest is BROAD: the world of crowdfunding is incredibly diverse and has garnered some very interesting spinoffs, like equity and debt crowdfunding.

Crowdfunding became really popular about a decade ago: Indiegogo launched in 2007 and the other large platform, Kickstarter, launched in 2009. In the decade or so since, there has been a constant flow of campaigns and projects supporting projects both big and small. Some of the most successful campaigns have brought in hundreds millions of dollars, everything from cryptocurrencies, consumer technology, food, smart home items, and games.

Indiegogo and Kickstarter are the two most popular examples of rewards-based crowdfunding. In this type of crowdfunding, consumers will give funds in exchange for a reward, usually the product or service that’s being funding. This allows savvy consumers to give direct support to companies and products that have great promise, and ensures that they are early adopters of cool technology.

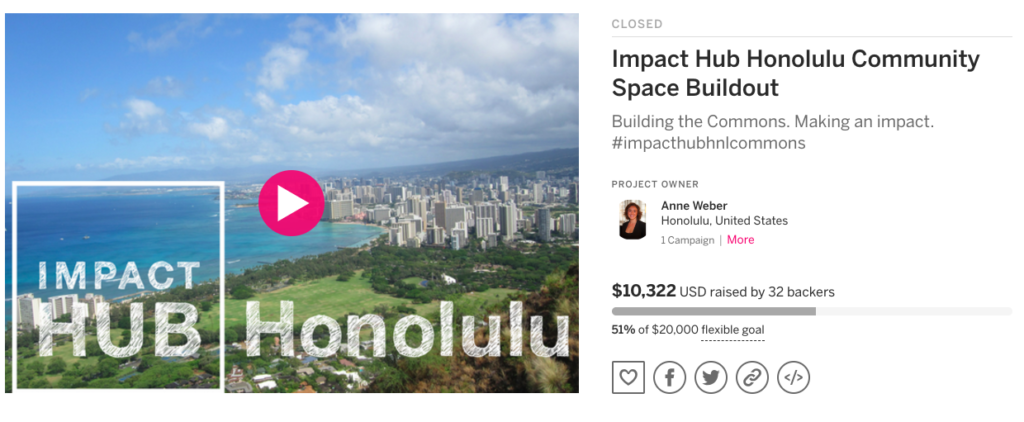

In 2017, Impact Hub HNL launched its first crowdfunding campaign on Indiegogo to raise scholarship funds for local groups and organizations who needed financial support. In the campaign the community contributed over $10,000, and we able to provide scholarships for 35 memberships, events, and programs, proving that crowdfunding can be a powerful tool for increasing equity.

Another type of fundraising is donation-based crowdfunding, which doesn’t ask for a return product or service. This includes sites like GoFundMe and Crowdrise, which often people use to raise money for themselves and their friends in need.

One of the biggest changes to the crowdfunding world came in 2015 with new rules that updated the Obama-era JOBS Act. This new ruling created exceptions to US securities and investment laws to allow anyone – not just accredited investors (ie: those with $1million net worth) – to become investors: thus, the creation of equity crowdfunding.

Equity crowdfunding allows ‘investors’ to give money to a company in exchange for shares, even if it’s just a small percentage. This created a huge shift in the investment world, and continues to democratize investment for the other 99%. Some examples of equity crowdfunding sites include SeedInvest, WeFunder, CircleUp, and StartEngine.

Another shift was the creation of Debt Crowdfunding (also known as peer-to-peer lending, or P2P lending). This model allows non-accredited investors to support individuals or businesses with direct financing. Examples of these sites include Prosper and LendingClub. These sites offer people a funding route that is not tied to banks, and gives investors an opportunity to support people and projects and earn money in return for their investment.

One of the most exciting things about both equity and debt crowdfunding is that they generate real results for both the investor and company. Debt crowdfunding can bring in returns of about 7%, which is on par with traditional investments. Equity crowdfunding can get startups off the ground with significant capital without the hassle of investors taking over the day-to-day of the company, it can be a great way to build a base of supporters, and offers a range of other benefits.

Of course, with any venture of this sort, it’s good to ensure that the company or product you are investing in (or supporting) has a good track record, is poised for successful delivery of product, or has good projections for return on investment. Any equity crowdfunding platform requires due diligence for the companies to be hosted on site, but it’s always good to do your own research before using your money. WeFunder explains that, “Startups either win big or go bankrupt. You could lose all your money. Consider them more like socially-good lottery tickets.”

Beyond just getting a cool, early-adopter product or receiving a good return on investment, crowdfunding is really a way to vote with your dollars for the world that you wish you see. This democratization of investment is key to building a world beyond traditional investment structures – most of which exclude women, people of color, lower income and otherwise marginal investors.

Voting with your dollars, whether for a product, service, or investment, allows you to expand your social impact and support businesses that align with your core values, which is has the potential for huge social, financial, and economic impact – something we can definitely support!